As regulatory pressures intensify and financial crime grows more sophisticated, the Banking and Financial Services (BFS) industry is undergoing a significant shift toward technology-driven risk management and compliance modernization. Organizations today must navigate a constantly evolving regulatory landscape while ensuring operational resilience, safeguarding customer trust, and maintaining competitive agility.

To support this transformation, BFS Risk and Compliance IT Services have emerged as critical enablers—integrating domain expertise, intelligent automation, and advanced analytics to help institutions manage risk more effectively and comply with global regulatory mandates.

Quadrant Knowledge Solutions’ latest market research offers a comprehensive analysis of this fast-evolving domain, capturing emerging market trends, competitive strategies, and the future outlook for BFS risk and compliance technologies.

Understanding the Market Landscape

Quadrant Knowledge Solutions’ research provides an in-depth evaluation of the global BFS Risk and Compliance IT Services market, examining:

- Short-term and long-term growth opportunities

- Evolving regulatory and compliance mandates

- Technology adoption patterns across global financial institutions

- Key market drivers, challenges, and investment priorities

This strategic intelligence helps:

- Technology vendors refine their offerings, align product strategies, and navigate competitive landscapes.

- Financial institutions assess vendor capabilities, understand differentiation, and select partners that align with their regulatory and risk transformation goals.

With rising expectations around governance, operational resilience, data transparency, and fraud prevention, IT service providers are playing a pivotal role in enabling compliance modernization across the BFS ecosystem.

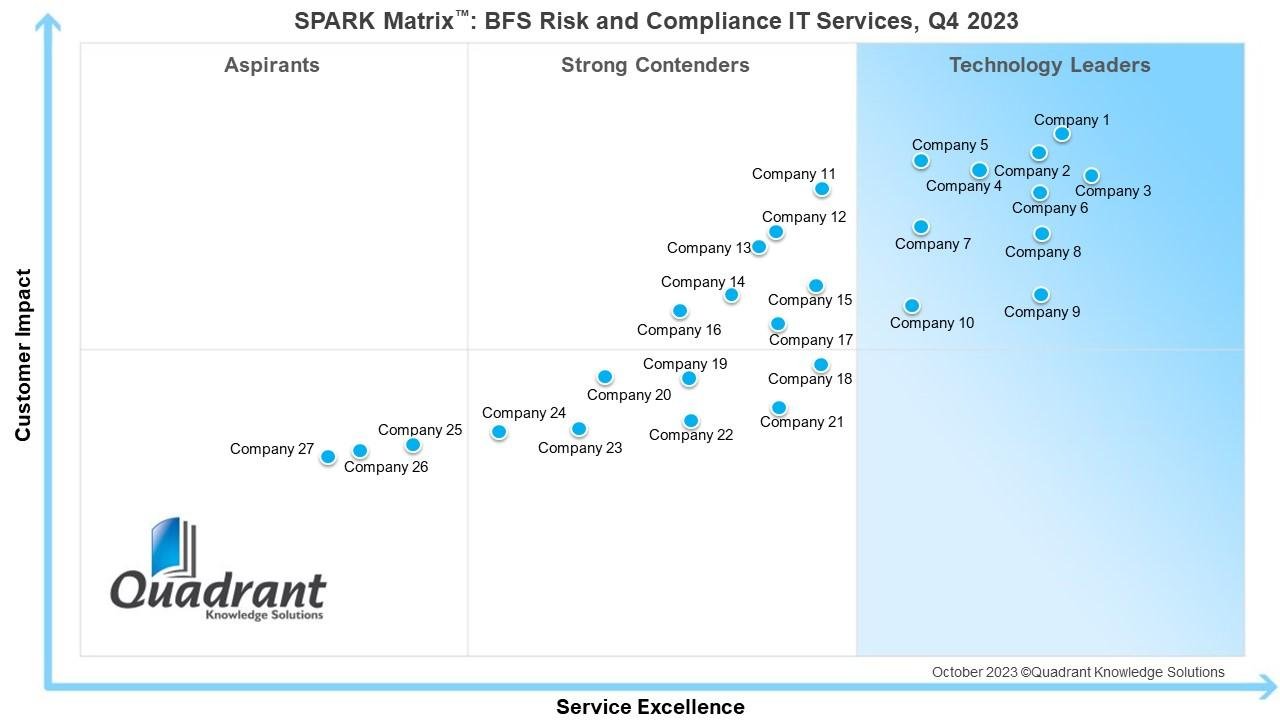

SPARK Matrix™: Evaluating Market Leadership

At the core of this research lies the proprietary SPARK Matrix™, which provides a multidimensional assessment of vendors based on:

- Technology excellence

- Customer impact

- Innovation, scalability, and performance

- Industry expertise and strategic execution

The SPARK Matrix™ evaluates globally recognized BFS Risk and Compliance IT Service providers, including: Accenture, Atos, Birlasoft, Capgemini, CGI, Cognizant, Deloitte, DXC Technology, EY, Happiest Minds, HCL Technologies, Hitachi Vantara, IBM, Infosys, KPMG, LTIMindtree, Maveric Systems, Mphasis, NSEIT, NTT DATA, PwC, Sopra Steria, TCS, Tech Mahindra, Virtusa, Wipro, and Zensar.

These vendors continue to shape the global compliance and risk management landscape with robust service portfolios, deep industry expertise, and next-generation technology capabilities.

What BFS Risk and Compliance IT Services Encompass

Banks and financial institutions face a growing need to safeguard their operations from regulatory non-compliance, fraud risks, and operational failures. BFS Risk and Compliance IT Services address these challenges across key domains, including:

1. Regulatory Compliance Management

Solutions that support ongoing adherence to global regulations such as KYC, AML, GDPR, Basel norms, FATF standards, and emerging global mandates.

2. Risk Assessment & Monitoring

Advanced frameworks for credit risk, market risk, liquidity risk, operational risk, model risk, and enterprise-wide risk governance.

3. Financial Crime & AML

Technology-driven approaches to fraud detection, suspicious activity monitoring, transaction screening, sanctions compliance, and behavioral analytics.

4. Cybersecurity & Identity Assurance

Services that strengthen digital trust through identity security, threat intelligence, cybersecurity controls, and secure data management.

5. Automation & Data Modernization

Use of AI, machine learning, RegTech solutions, and workflow automation to enhance compliance accuracy, reduce manual errors, and improve audit readiness.

The integration of these components allows BFS institutions to respond to regulatory demands with agility while ensuring a high level of security and customer trust.

Expert Perspective: Driving Regulatory Resilience Through Technology

According to an Analyst at Quadrant Knowledge Solutions, “BFS Risk and Compliance IT Services are specifically designed for the Banking and Financial Services (BFS) sector to address risk management and compliance needs. These services aim to assist financial institutions in navigating and adhering to the ever-changing regulatory environment governing their operations. The focus is on providing solutions that enable these institutions to adapt to evolving regulatory requirements, enhance their risk management capabilities, and ensure compliance across various aspects such as Know Your Customer (KYC), Anti-Money Laundering (AML), risk assessment, cybersecurity, financial crime, and overall enterprise risk.”

This perspective underscores the critical need for end-to-end IT services that can scale with regulatory expectations while empowering institutions with real-time insights and operational efficiency.

Future Outlook: Toward Intelligent, Predictive Compliance

The BFS industry is quickly moving toward proactive and predictive compliance models, driven by AI, analytics, cloud adoption, and integrated risk platforms. Key trends shaping the future include:

- AI-enabled regulatory automation and cognitive case management

- Real-time fraud detection using behavioral and transaction analytics

- Cloud-based compliance ecosystems

- Unified risk management frameworks

- Stronger emphasis on ESG compliance and sustainability reporting

As compliance complexity rises, financial institutions will increasingly depend on strategic IT service partners to enhance resilience, streamline operations, and ensure long-term regulatory alignment.

Conclusion

The BFS Risk and Compliance IT Services market is entering a pivotal era marked by heightened regulatory expectations, increasing cyber threats, and the need for technology-driven governance. Through its SPARK Matrix™ analysis, Quadrant Knowledge Solutions provides a clear, data-backed evaluation of the market, helping both vendors and institutions make informed decisions in this rapidly evolving landscape.

With the right combination of technology excellence, domain expertise, and strategic vision, leading service providers are enabling the BFS sector to build stronger, safer, and more compliant digital ecosystems.